Issues:

Sectors:

Keywords:

The following Knowledge Package elaborates on the mix of climate policies in the European Union (EU) and will introduce the main instruments according to targeted area. Furthermore, some information on the instruments’ performance within the policy mix will be given. More theoretical information on the workings of the implemented instrument types and their respective characteristics can be accessed via the Knowledge Package An overview of climate policy instruments applied in the EU.

1. Why do we need a policy mix?

1.1. Threefold target framework calls for multiple policies to address them

Within the 20-20-20 by 2020 strategy1 the EU agreed on a threefold set of targets addressing greenhouse gas (GHG) emissions, renewable energies (RES) and energy efficiency (EE). The installation of these three targets called for a mix of policy instruments, as it would have been impossible to tackle all three targets with just one single instrument.

Besides reducing GHG emissions, the 20-20-20 by 2020 strategy and its implementation, the 2020 Climate and Energy Package has the aim to increase energy security and strengthen the competitiveness of European economies. Furthermore the targets form part of the headline targets of the EU’s 2020 strategy for smart, sustainable and inclusive growth. Employment, Research & Development (R&D), Education and Fighting Poverty and Social Exclusion are further headline targets aimed for. Thus, climate policies have to be evaluated in this framework, also serving other policy aims than emissions reduction alone.

1.2. Different policy instruments can complement each other

In general, European climate policies vary in their design, approach and target group, and are born out of a variety of and trade-offs between political, legal, social and administrative factors and processes. There are some overlaps in the instruments and some policies compete, while others are complementary. Policies can be evaluated using three criteria: environmental effectiveness, cost effectiveness and additional impacts on society, such as on employment or income distribution that also determine the feasibility of the policy.

One way of categorizing climate policies is to subdivide them into market-based and non-market based instruments. Market-based instruments, like emissions trading or environmental taxation can have the advantage of cost-effectiveness, as they theoretically lead to the cheapest abatement options being implemented first. Nevertheless, these instruments can be subject to market imperfections. Also, economic agents not always perceive price signals in an optimal way or act rationally on price signals.

Non-market based instruments can reduce imperfections from price mechanisms, create direct abatement actions and implement direct incentives for innovation. Thereby, also currently uneconomic technologies can be developed to prevent technological lock-in and create future economic abatement options.

Finding the right policy mix is challenging as there is a high level of uncertainty over the outcomes regarding the three evaluation criteria and the interactions among the single policy instruments2. Diversity within the policy instruments implemented can reduce short comings of each single instrument and lead to complementary effects.

On the European level a share of climate policies are rather regulatory frameworks introducing targets, such as the ESD, or comprehending a multitude of further instruments, such as the Renewable Energy Directive (RED) or the Energy Efficiency Directive (EED). Each of the three targets from the 20-20-20 by 2020 strategy is connected to various policies to enforce compliance.

2. Ingredients of the EU-mix: main policies according to targeted sector

2.1. Greenhouse gas emissions

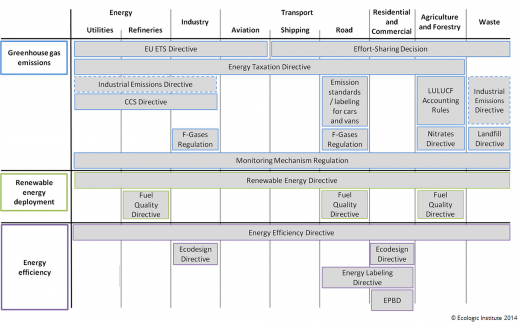

The 20% overall GHG emissions reductions target is mainly addressed by the EU’s emission trading system (EU-ETS)3, covering around 45% of the emissions under this target4, as well as the Effort-Sharing Decision (ESD), which introduces national targets set on the basis of Member States’ (MS) relative wealth (measured by Gross Domestic Product per capita). In addition, there are further, mostly sector specific policy instruments in place (see Figure 1)

The EU-ETS is a market-based instrument and enforces emissions reductions through the introduction of a carbon price through an emissions trading mechanism. Since the economic recession after 2008, demand for allowances decreased and thereby prices. Furthermore, although other policy instruments were considered in the design of the EU-ETS, target overachievement in some areas also had a reducing effect on allowance prices. The EU-ETS itself is not flexible enough to change the cap in the middle of a trading period to influence prices. Thus, low allowance prices failed to spur innovation in low-carbon technologies and thereby lower abatement costs in the future (dynamic efficiency)5. EU ETS was originally created to help the EU with reaching its Kyoto target and so formally it was not meant to deliver on any other goal, including driving innovations. In a climate policy system with only the EU-ETS in place, technological lock-in would have been the likely result. The interaction of the EU-ETS with other policy instruments can correct market failures (capital market imperfections, principal-agent problem), improve policy design and also meet further policy aims. In addition, no evidence for carbon leakage (reallocation of industrial production to unregulated countries) was found6.

The ESD covers so called non-ETS emissions, including emissions from households, buildings, transport, agriculture, services and smaller industrial installations. It is a framework instrument covering around 55% of EU carbon emissions and directly introducing binding national emission reduction targets. The ESD is reliant on further national instruments to fulfil its objectives.

Another market-based instrument are excise duties on energy products, including explicit carbon taxes. Non-carbon GHG emissions are rather marginally addressed by the current policy mix. While there are some polices in the fields of waste and industry, there is a lack especially in agriculture7.

Figure 1 gives an overview of the climate policies of the EU. It displays the main economic sectors (such as Energy, Industry, Transport et al), and which policies have been deployed for each of them under the three main target areas (greenhouse gases, renewables, efficiency).

2.2. Renewable energy deployment

The share/penetration of renewable energy (RES) is mainly driven by the Renewable Energy Directive8 which promotes renewable energy in electricity, heating, cooling and transport. MS set individual targets varying between 10 and 49%. Moreover, the share of energy from renewable sources in the transport sector must amount to at least 10 % of final energy consumption in the sector by 2020.

The major incentives for the development of RES sector in Europe have been the national support schemes, as the carbon price was too low to incentivise RES deployment, with feed-in-tariffs being the most effective policy tool9. The expansion of RES also has a positive impact on innovation, especially in less mature technologies10. A dynamic economic sector developed, creating jobs and company turnover. Furthermore, renewable energies contribute to reducing energy dependence of MS and improve local air quality. However, the static efficiency (cost effectiveness in the present) of RES promotion is not optimal, due to high abatement costs11. But as mentioned, the support of renewable energies works towards further targets than emissions reductions only.

2.3. Energy efficiency

Energy efficiency (EE) is tackled by a number of sector specific approaches, including taxation measures, standards and information tools. Since 2012 the Energy Efficiency Directive is in place as a common framework of measures for the promotion of EE. It requires MS to set national energy efficiency targets in an area of their choice (such as primary of final energy savings, energy intensity or energy consumption). More transparency of energy consumption for consumers, energy audits for enterprises and renovation of public buildings are also introduced. Furthermore, the efficiency of energy generation is supposed to be improved12

Climate policies targeting EE have been mainly focussing on buildings and transport. However, further efforts are needed to meet the 2020 target13 In transport, the implemented policy mix improved vehicle efficiency but failed to trigger modal shift. Transport is the only main sector where emissions still continue to grow. Energy taxes in the MS are often not optimal, as they often do not correctly reflect the fuel’s carbon content. Nevertheless, empirical research shows that MS with high energy taxes encourage more innovation in energy efficient technologies14 In the buildings sector, the policy mix led to an improvement of EE. However, these improvements where partly compensated by rebound effects and did therefore not lead to a proportional reduction in energy consumption. Energy prices were too low to spur innovation. Here, EE standards, e.g. introduced through the Energy Performance of Buildings Directive (EPBD)15, have been the main drivers16.

3. Additional impacts of the policy mix

On the one hand, the introduction of climate policies supports the creation and development of a competitive and dynamic industry sector, which contributes significantly to growth and employment in the MS’ economies and acted as an economic stabiliser during the economic crisis after 200817.

On the other hand, policy makers need to keep in mind that the cost burden introduced by energy taxes or support schemes such as feed-in tariffs might be distributed disproportionately on households and small businesses, as energy-intensive industries are usually exempt. Especially for low-income households the cost burden can be significant. This bears the danger of reducing public acceptance. Subsidy programmes, e.g. for energy efficiency in buildings, usually have a higher acceptance, as the funding source and total amount is less visible, coming mostly from tax money. However, a rising public debt level and increasing burden on taxpayers might also reduce acceptance of these instruments18. Therefore, additional revenues from instruments such as emissions trading with auctioning or taxes should be used to benefit the broader public to create an effective, efficient but also politically feasible instrument mix.